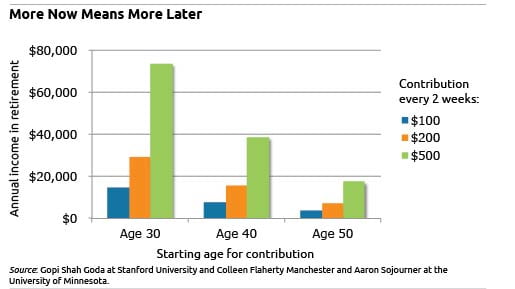

"Determining how much money one will need in retirement is a mathematically and psychologically daunting task for many Americans. But new research has landed on a deceptively simple strategy for prodding workers to save.

Employees in an experiment at the University of Minnesota saved more for retirement after researchers provided them with a personalized chart with information similar to that shown below. Each employee’s chart translated a $100, $200, or $500 contribution, made every other week, into the amount of income each of these contributions would generate annually once they retired. If they saved more, they could see that it translated to more retirement income." Learn more about this concept at the Center for Retirement Research's "Squared Away Blog" and consider what it means to your own life: http://squaredawayblog.bc.edu/squared-away/translating-savings-to-retirement-income/

Translating Savings to Retirement Income

![Translating Savings to Retirement Income]()

Reviewed by Pisstol Aer

Published :

Rating : 4.5

Published :

Rating : 4.5